Nominal account: The expenditures and losses are debited, while the incomes and gains of the business are credited. The bookkeeping process categories transactions into subcategories under these. Personal Account: The individual who receives the benefit will be debited, and the one who gives the benefit will be credited.Īsset account: The asset which is brought into the business through purchase is debited, and asset which is going out through sale is credited. The accounting formula is assets less liabilities equals owners equity. After identification, the increase or decrease has to be determined, and the effects on debit and credit.īased on the type of accounts, the rules can be simplified, as follows: When a transaction takes place at first, it has to be analyzed to determine whether it is an asset, liability, dividend, revenue, expense, or equity capital of the business. When liability, income, and capital decreases, debit it. When liability, income, and capital increases, credit it. When assets and expenses decrease, credit it.

You, as head of the bike company, should also record this. The amount is listed here under this liability account, showing that the amount is to be paid back. This means the amount is deducted from the bank’s cash to pay the loan amount out to you. When assets and expenses increase, debit it. The 15,000 is debited under the header Loans. The rules of debit and credit are used in formulating the journal entries and ledger accounts, they are as follows: Debits and credits help in keeping track of the transactions that take place in a business, and also maintain the correct value of the assets and liabilities.

LIABILITY DEBIT CREDIT HOW TO

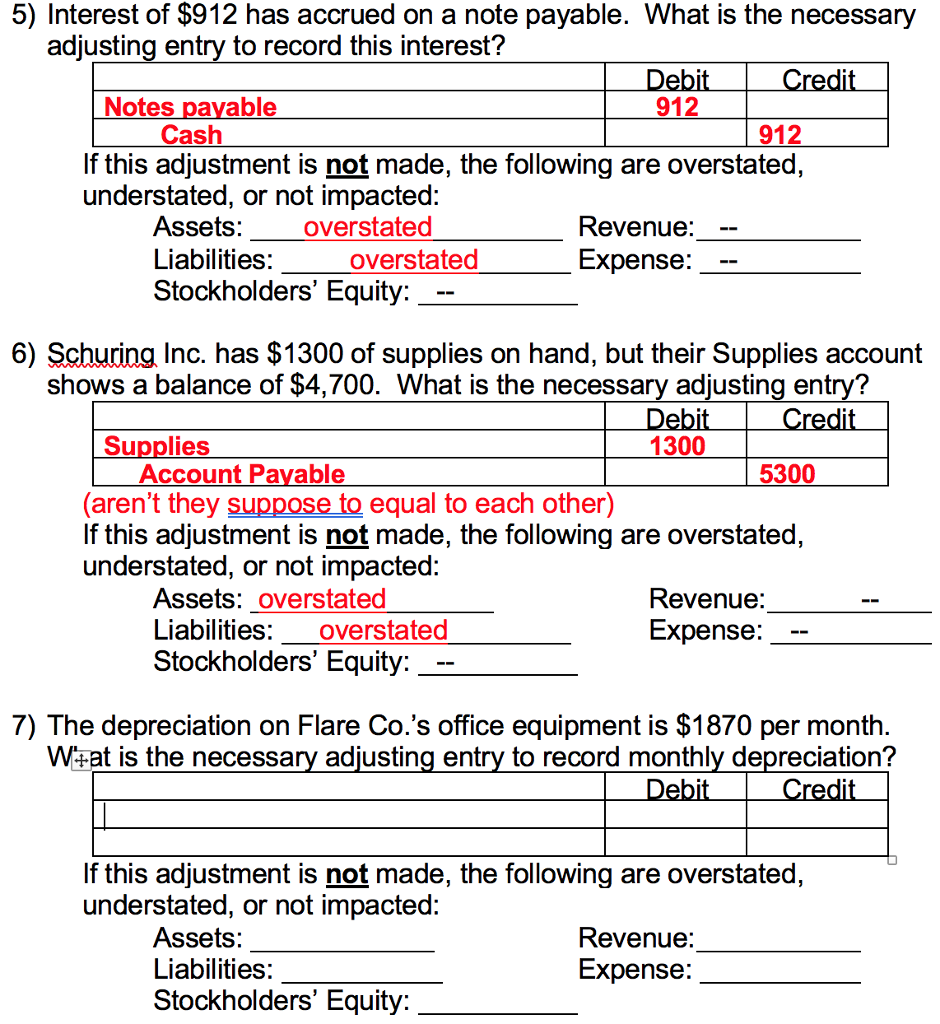

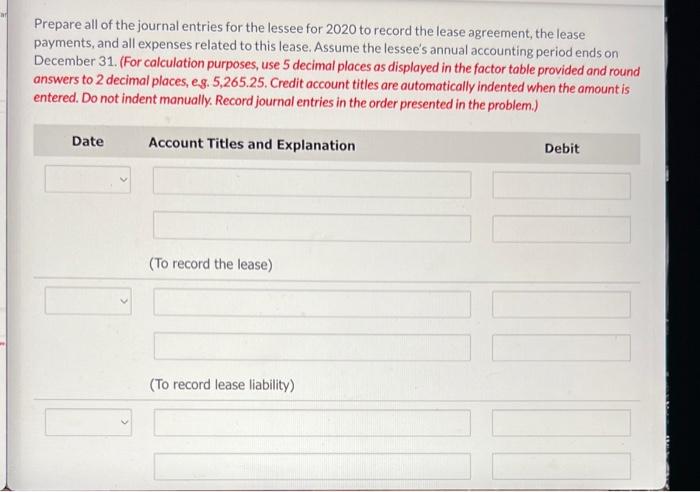

Next we look at how to apply this concept in journal entries.Debits and credits form the fundamentals of the accounting system. You should be able to complete the debit/credit columns of your chart of accounts spreadsheet (click Chart of Accounts). Regardless of what elements are present in the business transaction, a journal entry will always have AT least one debit and one credit. Here is another summary chart of each account type and the normal balances. Remember, any account can have both debits and credits. The side that increases (debit or credit) is referred to as an account's normal balance. Expenses decrease retained earnings, and decreases in retained earnings are recorded on the left side. The reasoning behind this rule is that revenues increase retained earnings, and increases in retained earnings are recorded on the right side. The recording rules for revenues and expenses are: Revenues We also learned that net income is revenues - expenses and calculated on the income statement. We learned that net income is added to equity. Recording changes in Income Statement Accounts For Dividends, it would be an equity account but have a normal DEBIT balance (meaning, debit will increase and credit will decrease). This is called a contra-account because it works opposite the way the account normally works. There is an exception to this rule: Dividends (or withdrawals for a non-corporation) is an equity account but it reduces equity since the owner is taking equity from the company. Liabilities and stockholders' equity, to the right of the equal sign, increase on the right or CREDIT side.

Assets, which are on the left of the equal sign, increase on the left side or DEBIT side. Recording transactions into journal entries is easier when you focus on the equal sign in the accounting equation. The balance sheet proves the accounting equation. Recording Changes in Balance Sheet Accountsīalance Sheet accounts are assets, liabilities and equity. Then we translate these increase or decrease effects into debits and credits.

Note: This are general guidelines and we will have exceptions to these rules.Īfter recognizing a business event as a business transaction, we analyze it to determine its increase or decrease effects on the assets, liabilities, stockholders' equity items, dividends, revenues, or expenses of the business. It will be necessary for you to commit the rules for debits and credits to memory before you move forward in this course. Review this quick guide to recording debits and credits. Watch this video to help you remember this concept: The accounting requirement that each transaction be recorded by an entry that has equal debits and credits is called double-entry procedure, or duality. When we debit one account (or accounts) for $100, we must credit another account (or accounts) for a total of $100. In each business transaction we record, the total dollar amount of debits must equal the total dollar amount of credits. Remember the accounting equation? ASSETS = LIABILITIES + EQUITY The accounting equation must always be in balance and the rules of debit and credit enforce this balance. Debit simply means left side credit means right side. The meaning of debit and credit will change depending on the account type. We use the words "debit" and "credit" instead of increase or decrease. However, we do not use the concept of increase or decrease in accounting. One of the first steps in analyzing a business transaction is deciding if the accounts involved increase or decrease.

0 kommentar(er)

0 kommentar(er)